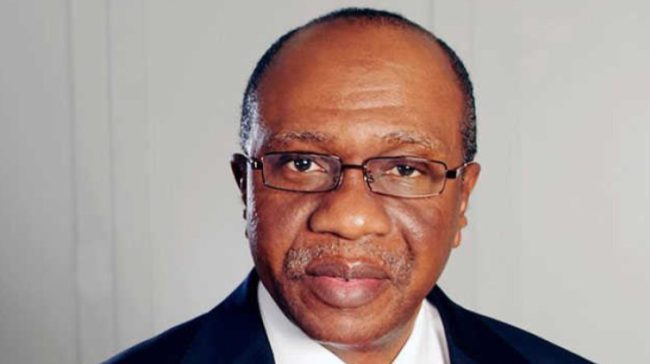

The ongoing probe of the immediate past Governor of the Central Bank of Nigeria, CBN, Godwin Emefiele by the Special Investigator appointed by President Bola Tinubu, Jim Obaze has allegedly revealed how the former Governor used proxies to acquire Union, Keystone, and Polaris Bank.

In his report, submitted to President on December 20, Obaze detailed how Union, Keystone, and Polaris Bank were acquired in 2019 allegedly by Emefiele and a late businessman, Alhaji Ismaila Isa Funtua in circumstances deemed fraudulent.

He further disclosed that the banks were acquired by the two individuals without evidence of payment.

Read Also: N4.8bn Fraud: Chief Chukwudozie Accuses Ibeto, Lawyer Of Falsehood

He rated Emefiele as a mysterious shareholder who gave an interest-free, long-term loan (with no fixed repayment schedule) to the entities that acquired the old-generation bank.

He said the two entities which acquired the bank do not have a physical presence in Dubai in the United Arab Emirates where they claim to be domiciled.

He said by Section 3(5) of the Banks and Other Financial Institutions Act they are not supposed to be allowed to operate or acquire a bank in Nigeria.

He said when he wrote the supposed owner of one of the entities and the ultimate acquirer of the banks to submit proof of funds, the said owner claimed to be indisposed. He said since September, he has not heard from him.

Although he said those involved in the transactions were seeking a “political solution”, he asked the Federal Government to recover the bank. He also recommended that the banks, Union, Keystone, and Polaris Bank acquired in 2019 be taken over by the government.

He said the banks should be strengthened and sold shortly.

He also said the internal loans created by the Afrexim Bank in the process of acquiring it were not being serviced and had gone bad.

He said a former Managing Director of the bank resigned due to consistent pressure from Emefiele and the shareholders to create the loans.

These disclosures were contained in two separate letters to President Tinubu on December 20th by Obazee.

On the acquisition of the old-generation banks, Obazee said he discovered that some persons were used as proxies by Emefiele to set up the main entity that acquired the bank.

He said his team has completed its investigation on the acquisition and has also held meetings with the relevant parties except an expatriate said to be hospitalized in Switzerland.

Read Also: Lagos Court Jails Chinese For Illegal Exportation Of Donkey Genitals

The investigator gave the storyline of the acquisition to support his findings.

He said the entity first sought the CBN’s no-objection to its proposed consolidation with the old generation bank, excluding its UK operations via a letter dated October 25, 2021. The entity stated that the consolidation was being contemplated in four phases.

·The acquisition of 91.5% of the issued shares of the bank

·Mandatory Tender Offer (MTO) for the remaining shares of the bank

Buy out of shares that are not voluntarily sold to it( entity)

on the MTO; and·Merger with the bank, with the bank now the surviving entity.

The entity, in its letter, stated that the consolidation was to be funded via a combination of debt and equity. CBN via letters dated March 3 and 9, 2022 granted no objections to the entity’s requests to obtain a $300,000,000 facility from Afrexim Bank as well as a capital injection of $175,000,000 from two of its existing shareholders.

The Union Bank Acquisition

In the report seen by our reporter, the detailed stages followed to acquire the Union Bank, one of the first-generation financial institutions in Nigeria, were contained in a memo to President Tinubu, titled, “Report of the Investigation of the Acquisition of Union Bank of Nigeria by Titan Trust Bank.”

The special investigator had requested the CBN to provide his team with all relevant documents, and from what he got, the name of Titan Trust Bank (TTB) was seen as the Special Purpose Vehicle (SPV) for the acquisition.

According to the report, in the documents from the apex bank, it was found that TTB had in a letter of October 25, 2021, sought CBN’s no-objection to its proposed consolidation with Union Bank excluding its UK operations.

This, the letter noted, should be in four phases: the acquisition of 91.5 per cent of the issued shares of the UBN; Mandatory Tender Offer (MTO) for the remaining shares of the UBN; buyout of any share not voluntarily sold to TTB on the MTO; and merger of TTB and UBN with UBN as the surviving entity.

It also stated that consolidation was to be funded via a combination of debt and equity, and CBN via letters dated March 3 and 9, 2022, which granted no objections to TTB’s request to obtain a $300,000,000 facility from Afrexim Bank, as well as capital injection of $175,000,000 from two existing shareholders of TTB; Messrs Luxis International DMCC and Magna International DMCC, all purportedly operating from Dubai in the United Arab Emirates.

The TTB, via a letter dated June 3, 2022, informed the CBN that it had made the payment of the purchase consideration to the selling shareholders on June 1, 2022, and had thus completed the acquisition of 93.4 per cent of the issued shares of the Union Bank.

The investigator stated in his report to the president, “When carrying out our investigation, we discovered that some persons were used as proxies by Mr Godwin Emefiele to set up Titan Trust Bank and acquire Union Bank, all from ill-gotten wealth. We were able to secure some documents, and investigation reports will lead to the forfeiture of the two banks by the federal government.

“We have completed our investigation on this acquisition and have also held meetings with relevant parties except for Mr Cornelius Vink (currently hospitalised in Switzerland). We are on the verge of recovering these two banks for the federal government,” the document showed.

Acquisition of Keystone Bank

In another finding titled, “Report of the Investigation of the Acquisition of Keystone Bank,” submitted by the special investigator to President Tinubu, it was stated that after due diligence, it was discovered that some persons were used as proxies with the connivance and assistance of Emefiele and the CBN to acquire the bank without evidence of payment.

It stated, “AMCON MD moved N20billion to Heritage Bank as placement sometime in 2010. On the back of that, Heritage Bank granted a loan of N25 billion to the promoters of Isa Funtua/Emefiele group’s acquisition vehicles to buy Keystone Bank.

“The loan was further backed by the shareholders of the bank. Upon acquisition, Keystone Bank returned the N20bn to Heritage Bank as placement. Thereafter, Heritage Bank repaid AMCON from the cash flow created.

“When the loan granted by Heritage Bank to Isa Funtua/Emefiele’s acquisition vehicles matured with an outstanding balance, the MD of Heritage Bank (which was then in serious liquidity crisis), called for repayment. Unfortunately for the shareholders of the bank, the Isa Funtua/Emefiele Group could not repay.

“Consequently, the MD of Heritage got his lawyers to write to the bank on two occasions, threatening to take over Keystone Bank based on the shares they had pledged as security.

“After much pressure from him, Keystone Bank created internal loans of about N50bn between June and October 2019 and moved the proceeds to repay Heritage Bank on behalf of their group. However, the MD of the bank at that time had resigned due to consistent pressure from him and the shareholders to comply. The internal loans so created are not being serviced and have gone bad.

“The special investigator has commenced the interrogation of the MD of AMCON to clarify the situation of the acquisition of both Polaris and Keystone banks beside Arik Air, Aero Contractors and the financial reporting by AMCON,” it stated.

The document showed that the investigator would continue the interrogation of the AMCON MD on Friday, December 22, 2023; and based on the preliminary report, Keystone was allegedly acquired for free, just as Polaris Bank.